Document Management System

Managing documents and account information is a time-consuming process. Let Yooma’s Document Management System keep everything simple and organised.

Our Yooma Document Management System offers an innovative solution to handle account and client information. Our solution takes care of everything accurately, from policy claims to financial submissions, while providing an efficient and user-friendly experience for you and your clients.

With our Yooma Document Management System, you can store and manage unlimited policyholders’ data, making it easier for your business to scale. So whether you have a few hundred or thousands of clients, our solution easily handles it.

Do You Need Our Yooma Document Management System?

The insurance industry relies heavily on documents, and consequently, policies, claims, and other important information must be properly documented and stored. These documents need to be easily accessible to you so that you can provide accurate and timely services to your clients.

The challenge worsens when you’re dealing with large volumes of information. If you have to sift through vast amounts of data to find the specific information you need, you’ll experience inefficiencies and delays in processing claims and policies.

A Document Management System is necessary if you wish to maintain a high level of service to your clients. Are you still trying to verify key details like ID number and birth date over email? It won’t be long before you’re swamped with different information from different people. To avoid further obstacles, implement a Document Management System.

Common Challenges Without Our Yooma Document Management System

Whether you’re a financial consultant, insurance manager, actuary, underwriting manager or intermediary, you must adopt a sustainable and organised approach to document management. However, it’s an overwhelming task without the right solution.

The following cover several challenges you could face without our Yooma Document Management System:

Difficulty Finding and Retrieving Documents. Do you manually search through stacks of paperwork for physical documents? Do you search through multiple folders and even multiple platforms for electronic files?

This problematic process delays processing claims, underwriting policies, and other tasks that rely on the availability of relevant documents. Ultimately, you’ll experience confusion and disorder.

Inaccurate Data. The absence of a comprehensive Document Management System can result in data entry errors. This can happen when documents are manually transcribed into an electronic system, leading to data inconsistencies, duplication, and inaccuracies.

If multiple versions of the same document exist, you or your team may also enter data from one version while ignoring data from another. This can cause errors in underwriting policies and processing claims, leading to potential financial losses for your company.

Noncompliance. Insurance industry professionals must comply with regulatory requirements. But without a Document Management System, keeping track of all the relevant documents required for compliance can be challenging. This can lead to missed deadlines, fines, and other penalties.

Furthermore, regulations are subject to change, and staying updated can be difficult without a central repository for all the relevant documents.

Weak Security.Insurance documents contain sensitive and confidential information, including personal and financial information. The risk of data breaches and unauthorised access to these documents is greater if you don’t have a Document Management System.

Reduced productivity. Manual processes for managing account and client documents are time-consuming, reducing productivity and costing you money by the minute.

Inability to collaborate. Without a Document Management System, there is a higher risk of miscommunication and errors between you and the parties you interact with.

For instance, if multiple team members work on the same document simultaneously, there may be version control issues, leading to confusion and errors.

Lack of scalability. As your company grows, the volume of documents you handle increases. Thus, you need a solution, such as Yooma’s Document Management System, built for scalability.

You can’t risk hurting your business’s capacity for growth and new business opportunities simply because of the way you manage documents.

Features of our Yooma Document Management System

Our Document Management System offers a wide range of features to eliminate time-consuming manual tasks while providing easy access to documents so you can make edits seamlessly.

The features of the Yooma Document Management System include the following:

- Manage networks and sessions. You can add or edit a network, view active sessions, and end an active session.

- Download account and client information policy documents and edit and update bank account details and policy beneficiaries.

- Alter policies; you can make alterations to individual components and remove or add features – for example, you can add a new client to be insured.

- Seamlessly filter policy billings, write off selected months, and conserve the policy for selected months

- Create, edit, and delete policy claims, upload the claims document, and view claims history.

- Upload and download policy files, and view the policy mandate.

- Select batch imports of a different campaign or product options from a drop-down menu to upload, view, and edit.

- Create financial submissions, download and submit the financial requests. You can also view the finanycial rejection files, download response files, and download, submit, and delete tape files for debit order submissions.

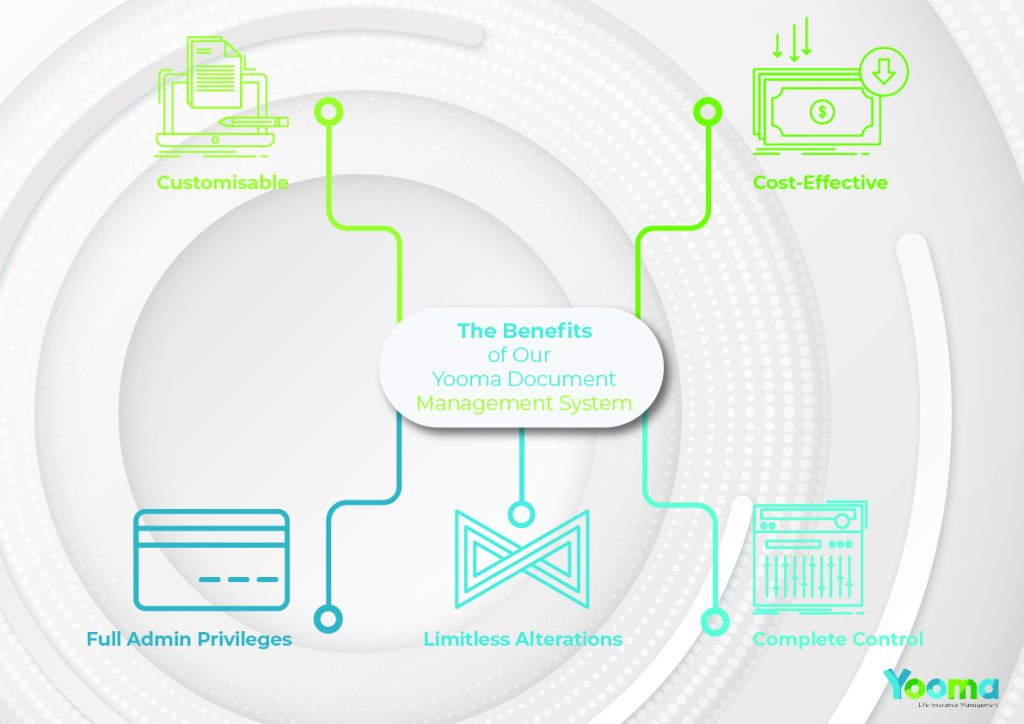

The Benefits of Our Yooma Document Management System

Yooma’s Document Management System allows you to verify your clients’ personal details, such as ID number, birth date, marital status, and much more.

The benefits of our Document Management System include the following:

Cost-Effective. Our premiums are flexible, set-up is cheap, you can pay set-up fees over project months, and you only pay for active policies.

Customisable. You can cede a policy, download policy documents, change a policy owner’s personal details, edit the bank account details, and add a new policy payer to the banking details.

You can even edit the policy beneficiaries and add new beneficiaries.

Complete Control. Our Document Management System gives you your very own control centre. You can add or remove the policy owners’ next of kin, add and remove a policy tag, and view all policy notes; the user who created the note can add and delete a policy note within 24 hours.

Limitless Alterations. The power’s in your hands. You can make alterations to all components and remove and add components – such as adding a new person to be insured, requesting a mandate, or adding additional products like a funeral or disability cover.

Full Admin Privileges. Our Document Management System gives you admin rights to manage processes. There’s an admin data import function, an admin grape dashboard (with changeable grape settings) and lookup tables where you view details such as bank names.

You can also add everything from bank names, branches, and campaigns to products, holidays, and more.